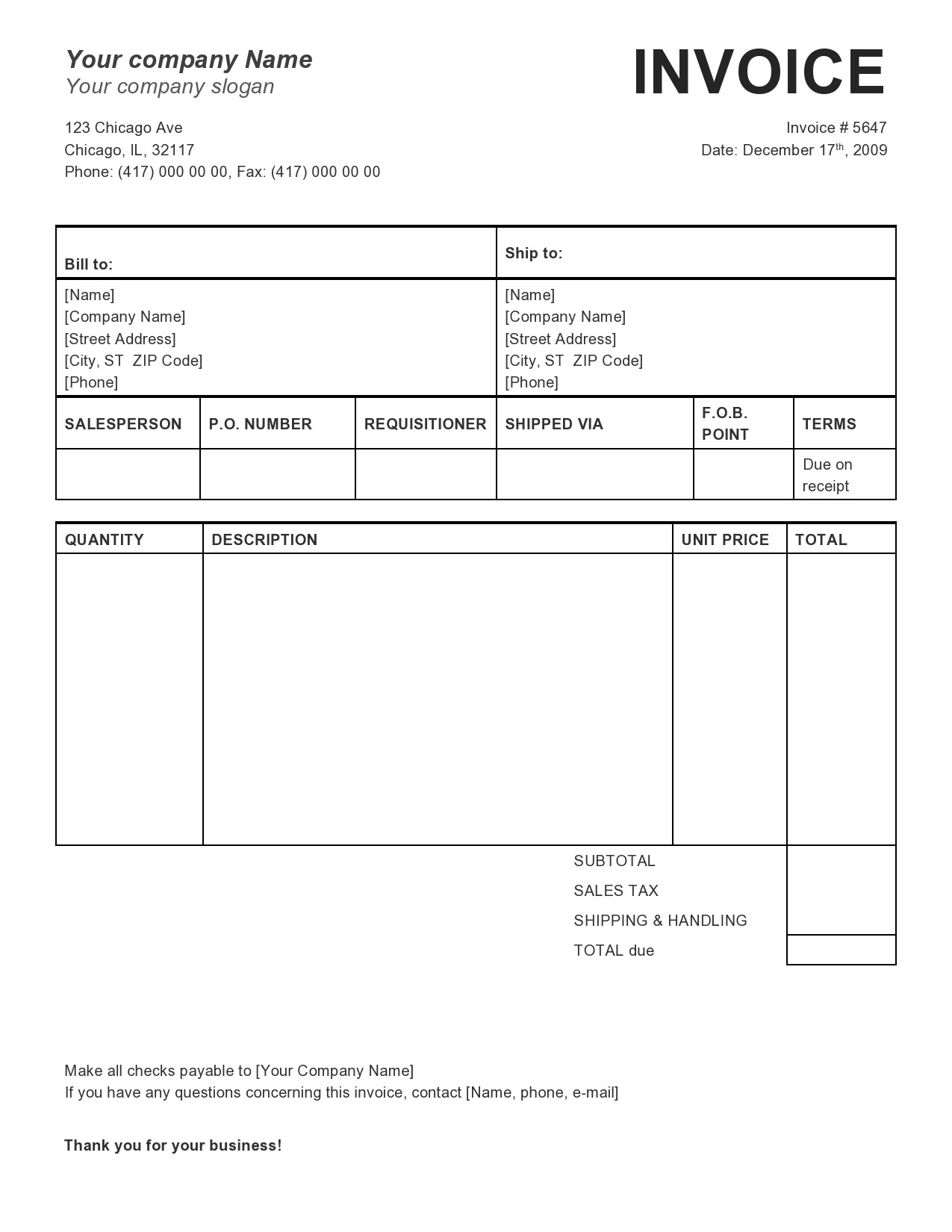

However, by omitting those details, you risk making the whole invoicing process more complicated and confusing. For example, if you don’t include a due date or payment terms, you can still receive a payment from your customer. We should emphasize that not every item from the above list is necessary for the invoice to be valid. Description of goods or services, price, and quantity.

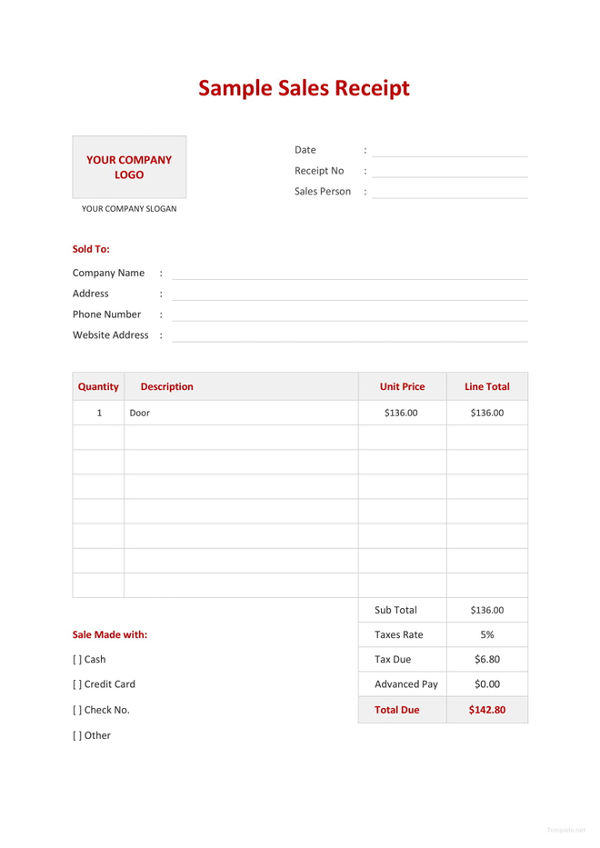

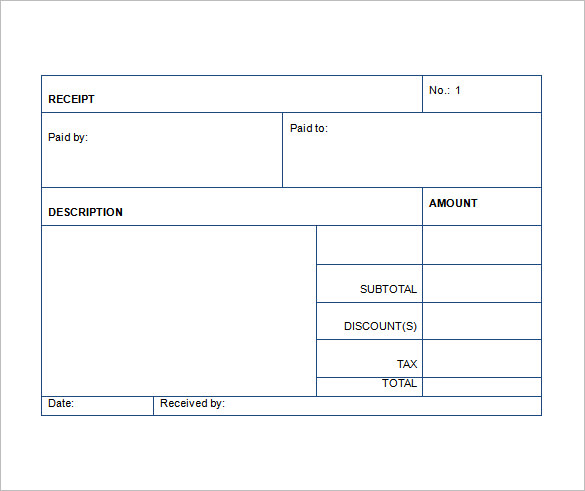

On the other hand, a receipt is a document you send to your customer as an acknowledgment that they’ve paid you. In other words, you’d issue an invoice after your work is done. You usually send them after the product or service has been delivered to the customer, but before the customer has paid for it. These two types of documents might be similar at first glance, but their purpose and contents are quite different.Īn invoice is a document you send to request payment from your customer. If you run any kind of business, invoices and receipts are definitely a part of your day-to-day practices. What to Include in a Receipt of Payment Templateīest Practices for Issuing Receipts of Payment The Difference Between an Invoice and a Receipt The Difference Between an Invoice and a Receipt In this article, we’ll show you some great receipt of payment templates that you can use to make issuing receipts a more efficient, straightforward, simple, and informative practice for you and your customers. When it comes to receipts, there’s one thing that often gets overlooked: they can be much more than a confirmation of received payment. They confirm that the customer has paid for the goods or services, so they’re essential for accounting, bookkeeping, and auditing purposes. Every legitimate business should issue receipts of payment.

0 kommentar(er)

0 kommentar(er)